Every day we offer FREE licensed iOS apps and games you’d have to buy otherwise.

iPhone Giveaway of the Day - Taxes App: Easy Tax Calculator

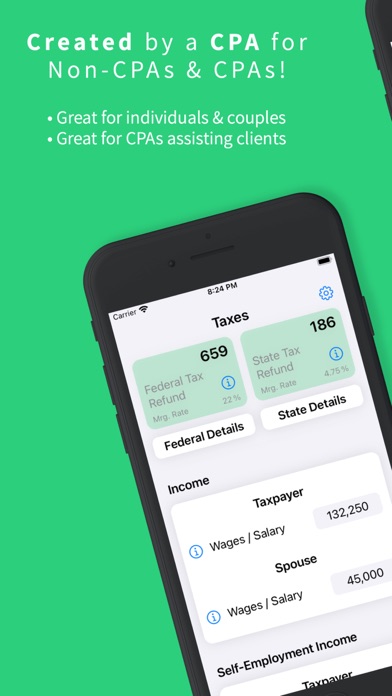

Taxes App: Easy Tax Calculator

is available as a Giveaway of the day!

You have limited time to download, install and register it.

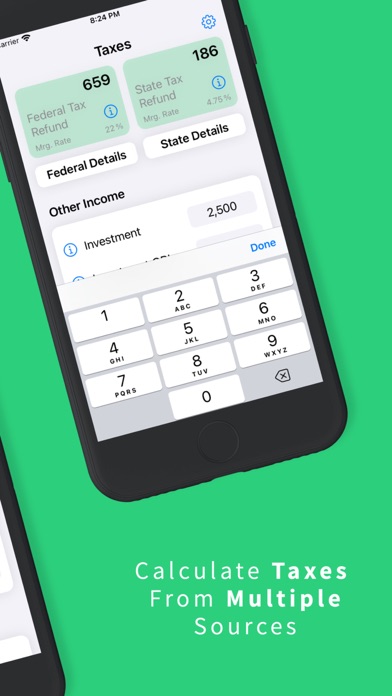

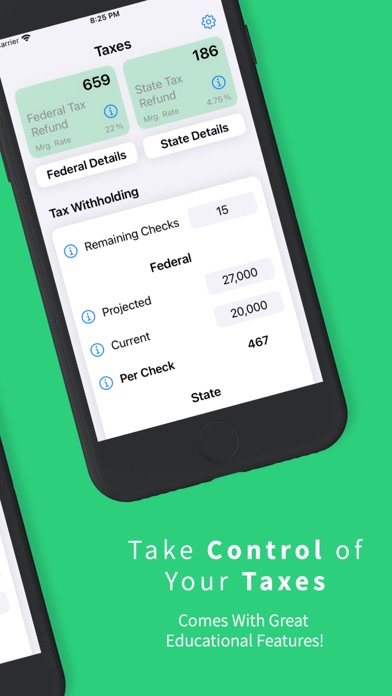

Taxes App helps estimate the correct amount of Federal and State taxes to withhold from your paycheck. If you are self-employed, it helps to estimate your estimated taxes. If you are employed, self-employed, have investment income, etc., it helps estimate income taxes for that too!

Taxes App is a simple but powerful United States income tax calculator intended to help you estimate your Federal and State income tax liability.

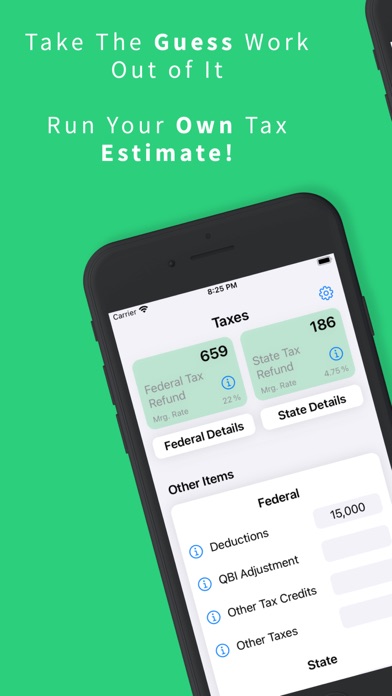

Taxes App is excellent for any Do-It-Yourself type of person and great for professionals assisting clients. Taxes App gives you the ability to run income tax projections in seconds. It’s also great if you want to learn more about different types of income, deductions, & tax credits and how those affect your tax bill.

Includes Tax Years 2023, 2022, & 2021.

Note - States are slow to update their tax brackets. If current-year state brackets are unavailable, prior-year brackets will be used until the state issues current-year brackets.

Federal calculations include:

- Ordinary federal income tax.

- Long-term capital gain tax.

- FICA tax.

- Self-employment tax.

- Self-employment tax deduction.

- Additional medicare tax.

- Net investment income tax.

- Qualified business income deduction with threshold & phaseout.

- Child tax credit with phase-out.

- Standard deduction.

- Displays marginal tax rate.

- Ability to manually add certain adjustments.

- Ability to run withholding/estimated tax payments projections.

State calculations include:

- Ordinary state income tax.

- Self-Employment Tax Deduction add-back - PA.

- Standard deduction, personal exemption, dependent exemption (does not include phaseout, but a few states do not calculate these based on a low-income phaseout).

- Federal QBI Deduction - CO, ID, & ND.

- Federal 50% QBI Deduction - IA (2022 & 2021 Only).

- Federal Income Tax Deduction - IA - (2022 & 2021 Only).

- Displays marginal tax rate.

- Ability to manually add certain adjustments.

- Ability to run withholding/estimated tax payments projections.

- Taxes App on most states calculates tax on state taxable income at ordinary state tax rates. This should overestimate taxes due if your state has favorable rates on certain types of income.

Taxes App is brought to you by Adam Myrick, CPA, a solo developer. If Taxes App is helping you and making your life easier, please consider supporting me by leaving a positive review or updating an existing one. Also, please share Taxes App with friends & family. As an indie developer, it makes a big difference. I’d appreciate it!

Developer:

Adam Myrick, LLC

Category:

Finance

Version:

1.6.1

Size:

3.1 MB

Rated:

4+

Languages:

English

Compatibility:

iPhone, iPad

Comments on Taxes App: Easy Tax Calculator