Every day we offer FREE licensed iOS apps and games you’d have to buy otherwise.

iPhone Giveaway of the Day - Insider Forms

This giveaway offer has expired. Insider Forms is now available on the regular basis.

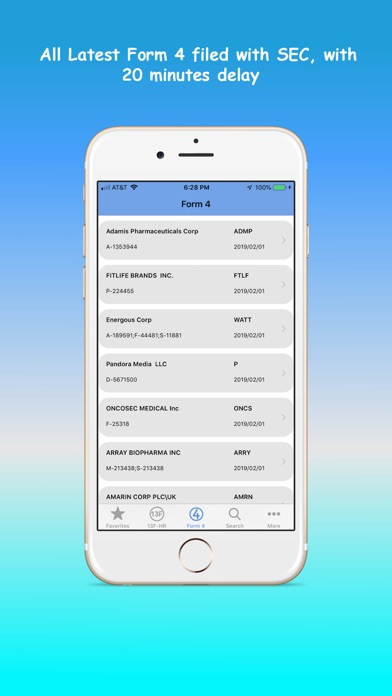

Insider Forms app provides information about Insider Trading activities (Form 4), Quarterly Institutional/Hedge Funds holdings (Form13F) reports that are filed with SEC. This information is provided in a formatted/summarized manner. You can view summary level information as well as detailed view, for the reports you like to view.

Features:

- All the latest Insider Trading and Quarterly Institutional/Hedge Funds holdings (Form 13F) reports, displayed with a delay of 20 minutes.

- Interactive Chart to compare the current and previous quarter Form 13F, along with summary of all the changes in the portfolio.

- Use search icon in Form 13F screen, to search large portfolios/ holdings.

- Receive notifications for your watch list items, for Insider Trading and institutional/hedge fund Form 13F activity in your portfolio.

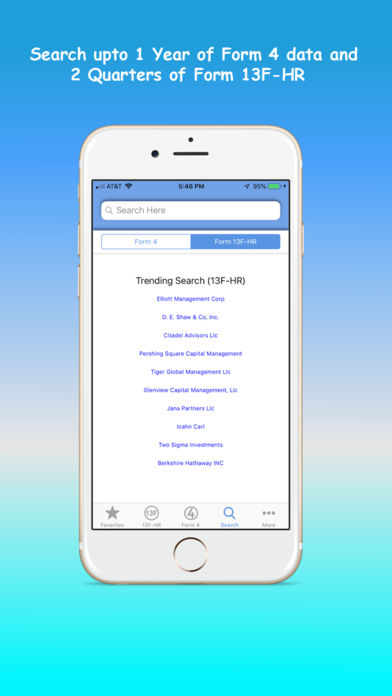

- Search historical data, up to 1 year of Insider Trading/form 4 and 2 quarters of Form 13F.

- Create unlimited watch list and track your favorite stocks or Institutions for any Insider Trading, Quarterly holdings report.

- Tap Filing person name, to open the actual SEC web page with information regarding the Form 4/ Form 13F that are filed with SEC.

- Description/Explanation of commonly used “Transaction codes”, in Form 4.

What is Form 13F:

Form 13F is a report that is filed by Institutional investment managers with at least $100 million in equity assets under management. Form 13F must be filed quarterly by institutional investment managers, usually within 45 days following quarter from the reporting period. Firms that are required to file 13F’s include mutual funds, hedge funds, trust companies, pension funds, insurance companies and registered investment advisers.

What is Form 4:

Form 4 is a public document that must be filed with the Securities and Exchange Commission (SEC) whenever there is a material change in the holdings of company insiders. when an insider executes a transaction, he or she must file a Form 4. Insiders consist of directors and officers of the company, as well as any shareholders, owning 10% or more of the company's outstanding stock. Insiders have two business days following the transaction to report details about the transaction to SEC using Form 4. The Insider, Form 4 report shows the Insider name, the relation to the firm (usually the insider's job title), the date of the transaction, the type of transaction (buy or sell), the number of shares traded, the share price at the time of transaction, nature of transaction (Tran Code), and the number of shares held by the insider after the transaction.

Developer:

Sujesh Prasannan

Category:

Finance

Version:

3.0

Size:

20.39 MB

Rated:

4+

Languages:

English

Compatibility:

iPhone, iPad

Comments on Insider Forms